Mutual funds are a smart way to grow your wealth. With the potential to generate returns that outpace inflation, they can help you achieve your financial goals effectively.

Doing the ‘right’ thing is a highly desirable virtue. The line between success and failure is often drawn not by knowledge or expertise alone, but by the ability to apply them consistently and with perseverance.

At the core of our mission is a relentless commitment to value creation for our customers. We strive to deliver continuous, long-term improvements and value-additions that exceed expectations in every endeavor.

A mutual fund is an investment vehicle where multiple investors pool their money together. A fund manager then invests these combined funds across various asset classes, including equities, debt, gold, and other securities, to generate returns. The gains and losses from these investments are distributed among the investors in proportion to their share of the investment.

“Small decisions can collectively make a significant impact on your investment journey. Having the right guidance can make all the difference.

To learn more about them, read our detailed guide on What are mutual funds.

A mutual fund is a trust that pools money from investors. Investors receive units of the fund based on their share of the total investment. This pooled money is then invested across various asset classes, including equities, debt, and other securities, by a fund manager appointed by the asset management company.

The fund manager’s goal is to generate strong returns. The gains or losses from these investments are distributed among the investors in proportion to their share of the total investment.

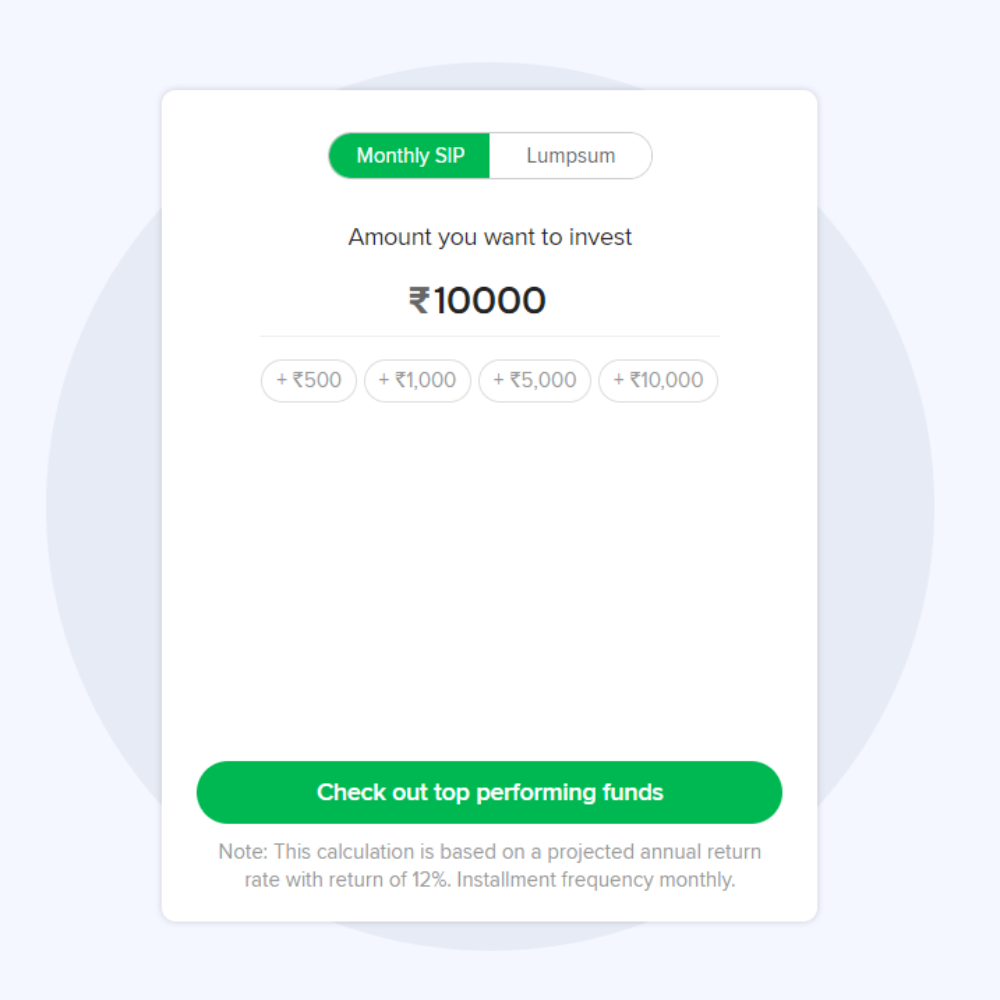

Choosing the right mutual fund involves assessing various factors since different funds have distinct risk-return profiles. Your decision should be based on your risk tolerance and investment time horizon.

Risk Tolerance: Determine how much risk you are willing to take. High-risk investments, such as equity funds, have the potential for higher returns but also come with greater volatility.

Investment Horizon: Consider how long you plan to stay invested. If your investment horizon is less than 3 years, investing entirely in high-risk equity funds may not be suitable.

Instead, you might opt for a balanced approach, such as investing in a mix of equity and debt funds, with a higher allocation to debt funds for more stability. By aligning your investment choices with your risk appetite and time horizon, you can select the mutual fund that best meets your financial goals.

When you withdraw from a mutual fund, if the redemption value exceeds the purchase price, the excess is classified as capital gains. The taxation of these gains depends on whether the gains are short-term or long-term, based on the holding period.

Equity Funds:

Debt Funds:

For detailed information about capital gains tax on mutual fund returns, you can refer to our comprehensive guide.